India Financial Services Conference

Building Equity and AI Dividend in a Multi Polar World

REGISTER NOW Become a PartnerAttacks, risk, and trust: Tackling emerging threats in an AI world.

Lorem ipsum dolor sit amet consectetur. Dui egestas in senectus suspendisse enim.Lorem ipsum dolor sit amet consectetur.

Overview

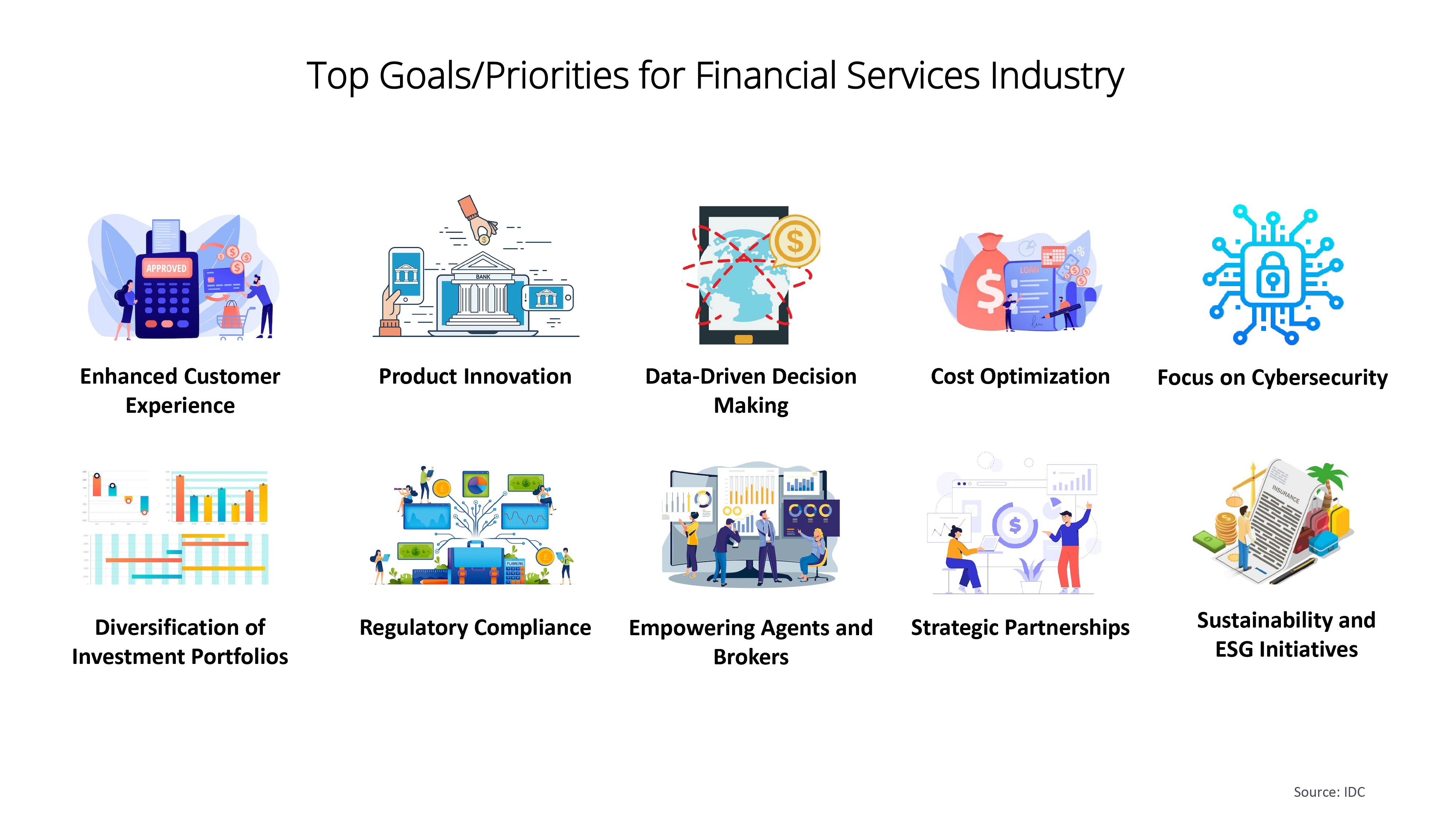

Based on the revised IMF estimates, India may become the fourth-largest economy in the world in 2025, marginally exceeding Japan to assume the position. In its April’25 report, with GDP growth normalized for trade tensions, the IMF referred to India as the fastest-growing major economy, with 6.2% forecasted growth. While the growth is excellent news, we should focus on the aspirational target in the context of India’s target of a 5 trillion-dollar economy in 2027. That goal would need India, especially its financial services sector, to supercharge efficiency and accelerate growth momentum. Their business priorities will drive financial services growth.

Three factors would be key:

1. Within BRIC+, the group is exploring a CBDC initiative. Indian banks may need to prioritize the initiatives.

2. AI is expected to be the 3rd largest electricity consumer by 2030, which makes sustainability a key initiative.

3. The priorities are for incremental spending. Some banks and insurers have made significant previous investments.

These would require a prudent technology investment strategy. Some of these areas could include.

1. Customer experience and revenues are correlated, and that should be a priority. From an Indian context, it is not just CX but the omnichannel experience. Customers want to interact in their preferred channel: channels, particularly digital channels. Also, enable access in remote areas. While pygital is the new mantra, branch access could be challenging outside the major centres.

2. We need new products as the focus shifts to commercial lending, and the existing customer journeys need to be thought through. Inclusion, SME lending, high-net-worth customers, and corporates would be the new growth mantra. Reimagining products would involve AI strategies.

3. Financial crime would continue to be a focus area. Uncertainty breeds crime. Unfortunately, financial crime is no longer restricted to transaction fraud but a wider net of AML, mule accounts, and, of course, internal fraud during uncertainty.

India Financial Services Conference 2025 will showcase insights from senior analysts, financial experts, industry trendsetters and thought leaders as they explore the latest trends and technologies driving the implementation and execution of these strategies prioritizing omnichannel engagement, financial inclusion, AI-driven products and proactive safeguards.

Expert Perspectives

Lorem ipsum dolor sit amet consectetur. Dui egestas in senectus suspendisse enim.Lorem ipsum dolor sit amet consectetur.

IDC Keynote: Accelerating India’s Transition to a Global Financial Services Superpower. Technology Strategies Gearing India for the Future

India is supercharged and ready for growth despite the geopolitical forces and financial services will need to play a large part to help drive this growth. Growth would need a fundamental shift in financial services strategy from supporting a largely consumption and services export driven economy to a helping reinvent it to one that is highly integrated with global, is an influencer and charts innovations patterns. Technological innovations supporting reinvention of financial services could be a game changer, and these strategies would be discussed.

Dr. Ashish Kakar | IDC Asia/Pacific

Research Director, Financial Insights

Dr. Ashish Kakar

Ashish is responsible for managing and developing IDC’s Financial Insights programs in the Asia/Pacific region.

Ashish has over 20 years of experience in banking, insurance, and investments. His last experience was starting and scaling his own award-winning, algorithmic investments venture. Previously, he had managed large enterprise-wide transformation and growth programs.

Academically, he is obtaining his Doctorate in Business Administration from Durham University, UK, and Emlyon Business School, France. He attained an MBA from IIM Bangalore.

His research interests include private assets, financial services, ESG, financial inclusion, and data-driven transformation. He also teaches data-driven innovation to the Durham University MBA and EMBA cohorts as a guest lecturer.

Ashish also has two publications. He presented a co-authored policy document on smart cities in the House of Lords, UK. He has also published a paper on private assets valuation at the 4th Sophia AI summit in Sophia Antipolis, France. A European platform featured his interview on importance of AI.

Ashish enjoys spending time with friends and family. He reads, can spend hours watching current events, visits historical monuments, and plays golf for leisure.

Event Sessions

Thursday, June 12 2025 5:55 pm | Location:

Fireside Chat: First AI-driven Digital Workspace Platform

The first AI driven digital workspace platform that enables smart, seamless and secure work experiences from anywhere! It uniquely integrates multiple industry-leading solutions including Unified Endpoint Management (UEM), Virtual Apps and Desktops, Digital Employee Experience (DEX), and Security & Compliance through common data, identity, administration, and automation services. Built on the vision of autonomous workspaces – self configuring, self healing, and self securing – We continuously adapt to the way people work; delivering personalized and engaging employee experiences, while optimizing security, IT operations and costs.

Q&A (Ask Questions, Rate the Session & Stand a Chance to Win a Cross Laptop Bag)

Thursday, June 12 2025 5:10 pm | Location:

IDC Keynote: Accelerating India’s Transition to a Global Financial Services Superpower. Technology Strategies Gearing India for the Future

India is supercharged and ready for growth despite the geopolitical forces and financial services will need to play a large part to help drive this growth. Growth would need a fundamental shift in financial services strategy from supporting a largely consumption and services export driven economy to a helping reinvent it to one that is highly integrated with global, is an influencer and charts innovations patterns. Technological innovations supporting reinvention of financial services could be a game changer, and these strategies would be discussed.

Venue

Global influencers shared powerful stories of how they confronted challenges — and created opportunities from them

The St. Regis Mumbai

Level 9, Astor Ballroom,

Phoenix Palladium,

462, Senapati Bapat Marg, Lower Parel, Mumbai

Lorem ipsum dolor sit amet, consectetuer adipiscing elit. Aenean commodo ligula eget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Donec quam felis, ultricies nec, pellentesque eu, pretium quis, sem.

Knowledge Hub

Analyst Spotlight: Are Indian banks ready to leverage technology for a positive impact?

Make no mistake—India is a growth story. While the IMF projects that global GDP will grow by 3.2% in 2025, India is expected to grow at 6.0%, or nearly double the rate. Recently, the World Economic Forum opined that India would account for 20% of global growth in the near future. The growth has also translated into banking and credit growth. Between 2020 and 24, banking credit grew by 11.8% per annum.

Dr Ashish Kakar

IDC Asia / Pacific

Research Director (Financial Insights)

Learn More

Analyst Spotlight: Decoding the Future of Indian Insurance: Trends Shaping Consumer Spending in 2025

As India’s economic trajectory for 2025 – 26 unfolds, as per the World Economic Forum, India will be 6% of the overall global growth. Besides, India Ratings & Research forecasts a 6.6% growth rate, while ICRA projects a slightly lower 6.5%, citing global uncertainties as a dampening factor. The Reserve Bank of India (RBI) corroborates the 6.6% growth outlook for FY 2024 – 25. However, inflation looms large as a significant disruptor at 4.8%, affecting consumer spending and urban demand recovery.

Surya Narayan Saha

IDC Asia / Pacific

Research Manager (Financial Insights)

Learn More

India’s ₹70,000 Crore Deepfake Crisis: How Financial Institutions Can Fight Back

Imagine receiving a video call from your bank’s CEO, urgently instructing you to approve a wire transfer. The face, voice, and mannerisms all check out. But it’s not your CEO—it’s a deepfake.

This isn’t science fiction. It’s a growing reality. Deepfake-driven financial fraud in India has surged by 550% since 2019, with projected losses reaching ₹70,000 crore in 2024 alone, according to a BusinessWorld report. With over 11 lakh video KYC calls taking place daily—86% of which are vulnerable to spoofing—the financial sector is under siege. Even the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) have warned investors against deepfake videos impersonating their CEOs. As trust erodes and attacks multiply, India’s financial institutions must act—decisively and immediately.

Adam Preis

Ping Identity

Director, Product & Solution Marketing

Learn More

Leveraging Business Impact AI to Drive Enterprise Transformation

Artificial Intelligence has moved beyond the realm of experimentation, actively reshaping how organisations operate, engage, and grow. From finance to retail, manufacturing to healthcare, AI’s enterprise potential lies in its ability to unlock value from data, enhance experience, and deliver measurable outcomes at scale, often challenged with constrained budgets and legacy infrastructures. In this context, AI is no longer optional; it is an industry-wide strategic priority.

Despite clear benefits, common barriers persist. Fragmented data ecosystems impede holistic analysis. Manual, judgement-driven processes introduce latency and inconsistency burdened with an increasingly complex regulatory landscape. If left unaddressed, these challenges will stall progress. However, they also present a collective opportunity for industry stakeholders to leverage AI. The potential for AI is manifold. By embedding intelligence at the core of key functions, enterprises can achieve agility and resilience that were previously unattainable.

Ramanan SV

Intellect Design Arena

CEO-India & South Asia

Learn MoreStay tuned for exciting news!

Lorem ipsum dolor sit amet consectetur. Dui egestas in senectus suspendisse enim.Lorem ipsum dolor sit amet consectetur.